NYSDOL Annualization of Fringe Supplements: Does it apply to me?

Let’s take a look. According to the New York State Department of Labor (NYSDOL,) employers have three options when it comes to providing NYS prevailing wage (PW) fringe supplements:

1 - Pay the PW fringe supplements as cash in the paycheck, along with the required prevailing wage base rate. Fringe supplements paid to an employee as cash are not subject to the annualization calculation. The NYSDOL defines “cash” as money given to the employee in a paycheck (reportable on an IRS Form W2) subject to all employee taxes (i.e., federal and state income tax) and subject to “burden” (i.e., FICA, possibly SUI.) Be careful, NYS prevailing wage fringe supplements deposited into a fully vested, qualified retirement plan are not considered to be a cash payment of the fringe supplements by the NYSDOL and are subject to NYSDOL annualization regulations.

2 - Use the fringe to provide a bona fide benefit plan for the employee, or

3 - A combination thereof.

(http://www.labor.state.ny.us/workerprotection/publicwork/PW_faq6.shtm#11)

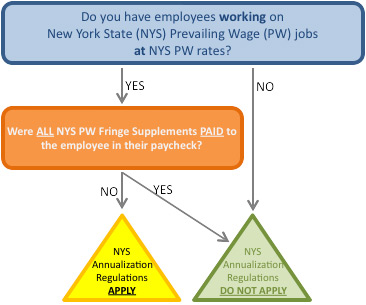

If you are using NYS prevailing wage fringe supplements in part or in total to provide bona fide fringe benefits, NYSDOL annualization regulations probably apply. It’s an easy question to answer with the simple flow chart below:

If you are not subject NYSDOL annualization regulations, Congratulations! Just remember, you are not taking full advantage of prevailing wage fringe supplements to purchase benefits you provide to your employees, and, the answer may change state to state and even in NY if you are working under the Davis-Bacon Act or for HUD.

Located in Rochester, NY, for over 25 years GMR has specialized in the development, placement, administration, and support of successful prevailing wage benefit plans meeting the compliance needs of the merit shop construction community. This year our clients will contribute tens of millions of prevailing wage fringe supplements to the Employee Benefit Trust and retirement plans, saving payroll burden on each of those dollars and making bids more competitive. Our current clients do prevailing wage work regulated by the NYSDOL, the USDOL, the MTA, and approximately 10 other states. Let us help you.